How to Evaluate Your Insurance Needs: A Step-by-Step Approach for Individuals and Families

Life is unpredictable. From sudden illness to natural disasters, unexpected events can disrupt your finances and long-term plans in an instant. Insurance is the safety net that protects you and your loved ones from financial hardship.

But buying insurance isn’t just about picking a policy with the lowest premium. To get the right coverage without overpaying, you need to carefully evaluate your unique needs. Here’s a step-by-step approach to help individuals and families choose the right insurance mix.

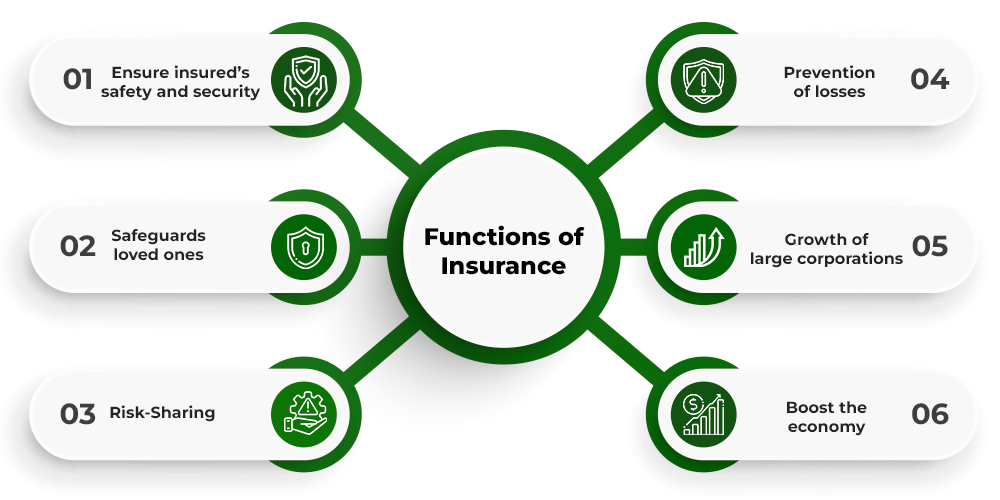

Step 1: Understand the Purpose of Insurance

Insurance is essentially a risk-management tool. You pay a relatively small premium so that an insurance company will cover large, unexpected expenses if a covered event occurs.

It doesn’t eliminate risk—it transfers financial responsibility.

Common categories of insurance:

-

Health insurance – Covers medical expenses, from routine checkups to major surgery.

-

Life insurance – Provides financial support to dependents if you pass away.

-

Property insurance – Protects your home or belongings against damage or loss.

-

Auto insurance – Covers costs related to vehicle accidents or theft.

-

Disability insurance – Replaces a portion of income if you cannot work due to illness or injury.

-

Liability insurance – Covers legal costs if someone sues you for injury or damage.

Knowing these categories will help you evaluate where you face the greatest financial exposure.

Step 2: Assess Your Personal and Family Situation

Insurance needs are deeply personal. Consider:

-

Household size and dependents – A single professional’s needs differ from a couple with young children.

-

Income level and stability – Higher incomes might require larger liability coverage; irregular incomes may need stronger income-replacement protection.

-

Existing assets and debts – A paid-off home, large savings, or significant loans change your risk profile.

-

Health status and lifestyle – Chronic illnesses, risky hobbies, or frequent travel can increase the need for certain coverages.

Write down your current life stage (single, married, parent, retiree) and note major life changes on the horizon (buying a house, having a baby, starting a business). These milestones often signal the need to update or add policies.

Step 3: Identify Your Key Financial Risks

Next, list the specific risks you want to protect against. Typical questions:

-

What would happen to my family’s finances if I passed away tomorrow?

-

Could we cover several months of expenses if I lost my job due to illness or injury?

-

If our home were damaged by fire or flood, could we rebuild without financial ruin?

-

If I caused a car accident, could I pay for damages and legal fees out of pocket?

This exercise clarifies which risks you can self-insure (by using savings) and which need to be transferred to an insurance company.

Step 4: Review Existing Coverage

Before buying new policies, examine what you already have:

-

Employer benefits: Many employers offer group health, life, or disability insurance. Check the coverage amounts and whether they continue if you leave the company.

-

Government programs: In some countries, social security or public healthcare provides partial coverage.

-

Credit card or membership benefits: Some cards offer travel or rental-car insurance.

Understanding existing protections prevents paying twice for the same coverage and reveals any gaps.

Step 5: Calculate Adequate Coverage Amounts

Now, estimate how much coverage you actually need in each area.

a. Health Insurance

Factor in:

-

Routine care and prescriptions

-

Potential major illnesses or accidents

-

Out-of-pocket maximums

Choose a plan balancing monthly premiums with deductibles you can afford.

b. Life Insurance

A common rule of thumb is 10–12 times your annual income, but refine it by considering:

-

Outstanding debts (mortgage, loans)

-

Future expenses (children’s education)

-

Day-to-day living costs for dependents

Subtract existing assets and savings to avoid over-insuring.

c. Disability Insurance

Aim to replace 60–70% of your income if you cannot work. Check if employer coverage is enough or if you need a supplemental private policy.

d. Homeowners or Renters Insurance

Ensure coverage equals the cost to rebuild your home (not just market value). Include personal belongings and liability protection.

e. Auto Insurance

Minimum legal requirements vary, but consider higher liability limits if you own significant assets.

f. Liability (Umbrella) Insurance

If your net worth exceeds your auto or home liability limits, an umbrella policy provides extra protection—often millions of dollars in coverage at relatively low cost.

Step 6: Compare Policy Options

Shop around to find the best balance of coverage and cost.

-

Request quotes from multiple providers or use independent brokers.

-

Examine deductibles, exclusions, and claim processes, not just premiums.

-

Check the insurer’s financial strength ratings (e.g., A.M. Best, Moody’s).

Remember: the cheapest policy isn’t always best if it leaves you under-insured or denies claims for common scenarios.

Step 7: Factor in Your Budget

Insurance should fit comfortably into your budget without compromising essential expenses or savings goals.

A good guideline:

-

Core protection (health, life, home/auto) is a priority.

-

Optional policies (pet insurance, extended warranties) come after emergency savings and retirement contributions are on track.

If money is tight, focus first on high-impact coverage that protects against catastrophic losses.

Step 8: Plan for Life Changes

Your insurance needs will evolve. Review policies:

-

Annually, to adjust coverage for salary changes, new dependents, or debt payoff.

-

After major milestones: marriage, divorce, birth of a child, home purchase, or retirement.

Update beneficiaries and coverage levels to reflect your current situation.

Step 9: Maintain Good Records

Keep digital and physical copies of:

-

Policy documents

-

Contact details for agents

-

Premium payment records

-

Claim instructions

Easy access ensures quick action in emergencies and prevents missed renewals.

Step 10: Seek Professional Advice When Needed

Complex situations—like owning a business, high net worth, or multiple properties—may require guidance from:

-

Certified financial planners (CFPs)

-

Independent insurance brokers

-

Estate attorneys or tax advisors

They can help you evaluate risks holistically and integrate insurance into your broader financial plan.

Common Mistakes to Avoid

-

Underestimating long-term care needs: Medical costs in retirement can be significant.

-

Relying only on employer coverage: If you change jobs, benefits may lapse.

-

Choosing the lowest premium without checking exclusions: Cheap policies can carry hidden gaps.

-

Forgetting to update beneficiaries: Outdated designations can cause legal disputes.

Bringing It All Together

Evaluating your insurance needs isn’t a one-time task—it’s an ongoing process of risk assessment and financial planning:

-

Understand the purpose of insurance.

-

Assess your household’s unique risks.

-

Review existing coverage and fill gaps.

-

Calculate appropriate coverage amounts.

-

Compare policies and providers.

-

Adjust regularly as your life evolves.

By following these steps, individuals and families can protect themselves from financial shocks and ensure that, no matter what the future holds, they are prepared and financially resilient.

Leave a Reply